All Categories

Featured

Table of Contents

Extra quantities are not assured beyond the duration for which they are proclaimed. Transforming some or all of your cost savings to revenue advantages (referred to as "annuitization") is an irreversible choice. When income advantage repayments have started, you are not able to alter to an additional option.

These extra quantities are not ensured past the period for which they were proclaimed. These estimations utilize the TIAA Typical "brand-new money" income rate for a single life annuity (RUN-DOWN NEIGHBORHOOD) with a 10-year assurance duration at age 67 using TIAA's basic settlement approach beginning revenue on March 1, 2024.

The result ($52,667) is first income for Individual B in year 1 that is 32% greater than the first income of Participant A ($40,000). Earnings rates for TIAA Standard annuitizations go through alter monthly. TIAA Conventional Annuity income advantages include assured amounts plus added quantities as may be proclaimed on a year-by-year basis by the TIAA Board of Trustees.

Retirement Income Annuity

It is an agreement that comes with an agreement describing specific guarantees. Set annuities guarantee a minimum price of rate of interest while you save and, if you select life time revenue, a minimum month-to-month quantity in retired life (inflation protected annuities). Converting some or all of your savings to earnings advantages (described as "annuitization") is a long-term choice

An ensured life time annuity is an economic product that promises to pay its owner revenue on a routine basis for the remainder of their life. Right here's just how ensured lifetime annuities work and just how to determine if one is ideal for you.

Surefire life time annuities are not government insured however might be covered by a state guaranty fund. Guaranteed life time annuities, often called ensured lifetime earnings annuities, are agreements marketed by insurance provider. Their main marketing point is that the buyer will certainly never ever need to fret about lacking money as they age.

Annuity Marketing Services

The purchaser of an ensured life time annuity pays the insurance company either a swelling sum of money (a single-premium annuity) or a collection of premiums (a multiple-premium annuity). In return, the insurance company consents to give the buyerand their partner or an additional individual, when it comes to a joint and survivor annuitywith a surefire earnings forever, despite how much time they live.

Some annuities, nevertheless, have a return-of-premium function that will pay the annuity owner's beneficiaries any kind of cash that remains from the original costs. That can happen, as an example, if the annuity proprietor passes away early right into the contract. Some annuities additionally offer a survivor benefit that functions similar to a life insurance policy policy.

In some feeling, a lifetime annuity is a wager in between the insurance coverage company and the annuity's owner. The insurer will certainly be the victor if the owner passes away before a particular point, while the owner will come out ahead if they amaze the insurer by living longer than anticipated.

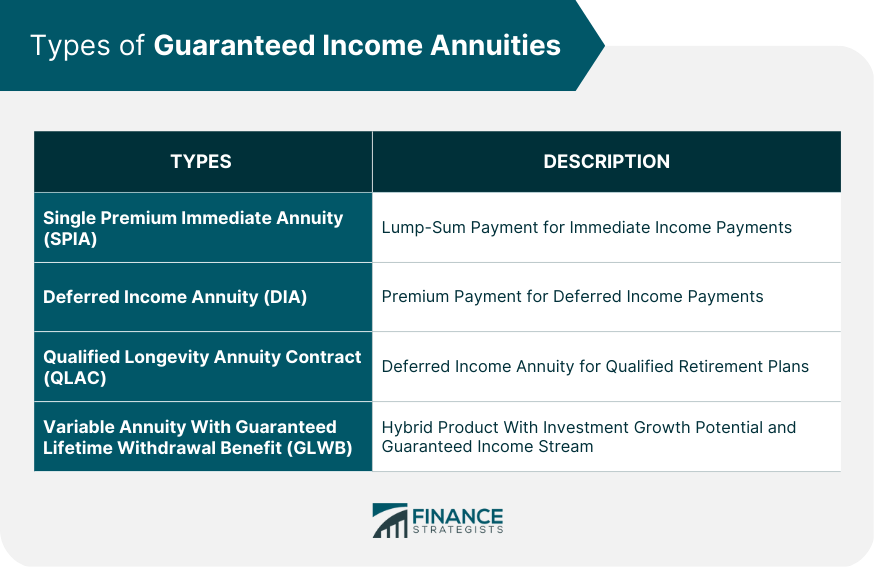

These are a few of the standard kinds: With an immediate annuity, the owner can begin to obtain revenue as soon as possible. The quantity of that benefit can either be taken care of permanently or, if the annuity has a cost-of-living adjustment (SODA) stipulation, readjust occasionally for rising cost of living. There are likewise prompt variable annuities that base a portion of their payment on the performance of underlying financial instruments like supplies, bonds, and common funds.

In the meanwhile, the annuity will remain in what's called its buildup phase. Deferring income can allow the account to grow in worth, leading to greater payouts than with an instant annuity. The much longer that earnings is postponed, the greater the potential build-up. Immediate annuities have no buildup phase.

What Are The Best Annuity Companies

A variable annuity, on the various other hand, will pay a return based on the financial investments that the owner has actually chosen for it, normally several mutual funds. When the payment stage begins, the owner might have a choice of receiving set payments or variable payments based upon the continuous performance of their financial investments.

Since it is likely to have a longer payment phase, a joint and survivor annuity will generally pay much less each month (or various other time duration) than a solitary life annuity.

Variable Annuity Company

, or other investments. They additionally have some drawbacks.

An ensured lifetime annuity can supply income for the remainder of the proprietor's life. It can also be made to pay earnings to a making it through partner or other individual for the rest of their life. Guaranteed lifetime annuities can begin their payouts right away or at some point in the future.

Annuities can be pricey, nevertheless, and, relying on how much time the owner lives and obtains repayments, might or may not confirm to be a good financial investment.

An instant annuity lets you promptly transform a swelling sum of money right into a guaranteed stream of revenue.

Your income is assured by the firm that issues the annuity. Make certain the firm you acquire your annuity from is financially sound. This information can be gotten from the leading independent rating agencies: A.M. Finest, Fitch, Moody's, and Criterion & Poor's. New York City Life has actually made the highest ratings for monetary stamina currently granted to united state

What Is Annuity Investment

2 An earnings annuity can assist secure versus the risk of outliving your savings. The quantity you obtain each month is guaranteed, and settlements will certainly continue for as long as you live. 1 Keep in mind that earnings annuities are not liquid, and your costs is returned to you just in the form of revenue settlements.

A fixed-rate annuity has a specified price of return and no loss of principal because of market downturns. It allows the owner to make higher interest than bonds, cash markets, CDs and various other financial institution items. The investment expands tax-deferred, which means you will certainly not need to pay tax obligations on the passion until you withdraw money from the annuity.

Assured minimal rate of return for a details duration. Your investment will expand tax-deferred till you take a withdrawal. There is no market danger with a fixed annuity. Your principal is protected and guaranteed to gather at a fixed price. Fixed annuities supply some liquidity, usually 10% of the agreement's gathered worth is available penalty-free on an annual basis if you more than 59, and some dealt with annuities permit you to take out the passion on an annual basis.

Simple Annuity Definition

We provide a free assessment to examine your existing retirement strategies and can supply a financial investment method that will provide the cash you require to live comfortably in your golden years. Get in touch with our workplace or give us a call at ( 614) 760-0670 to schedule your first assessment. Annuities are created to be long-lasting financial investments and frequently include costs such as earnings and death benefit biker charges and surrender charges.

Table of Contents

Latest Posts

Understanding Fixed Income Annuity Vs Variable Annuity A Comprehensive Guide to Tax Benefits Of Fixed Vs Variable Annuities What Is Fixed Annuity Vs Variable Annuity? Advantages and Disadvantages of D

Analyzing Strategic Retirement Planning Everything You Need to Know About Pros And Cons Of Fixed Annuity And Variable Annuity What Is Fixed Vs Variable Annuities? Benefits of Choosing the Right Financ

Breaking Down Fixed Vs Variable Annuities A Closer Look at Choosing Between Fixed Annuity And Variable Annuity Breaking Down the Basics of Investment Plans Features of Immediate Fixed Annuity Vs Varia

More

Latest Posts