All Categories

Featured

Table of Contents

In my opinion, Claims Paying Capacity of the service provider is where you base it. You can look at the state guaranty fund if you desire to, however bear in mind, the annuity mafia is enjoying.

They know that when they place their cash in an annuity of any type of type, the business is mosting likely to back up the case, and the industry is looking after that also. Are annuities assured? Yeah, they are - individual retirement annuity. In my opinion, they're safe, and you need to go right into them looking at each carrier with confidence.

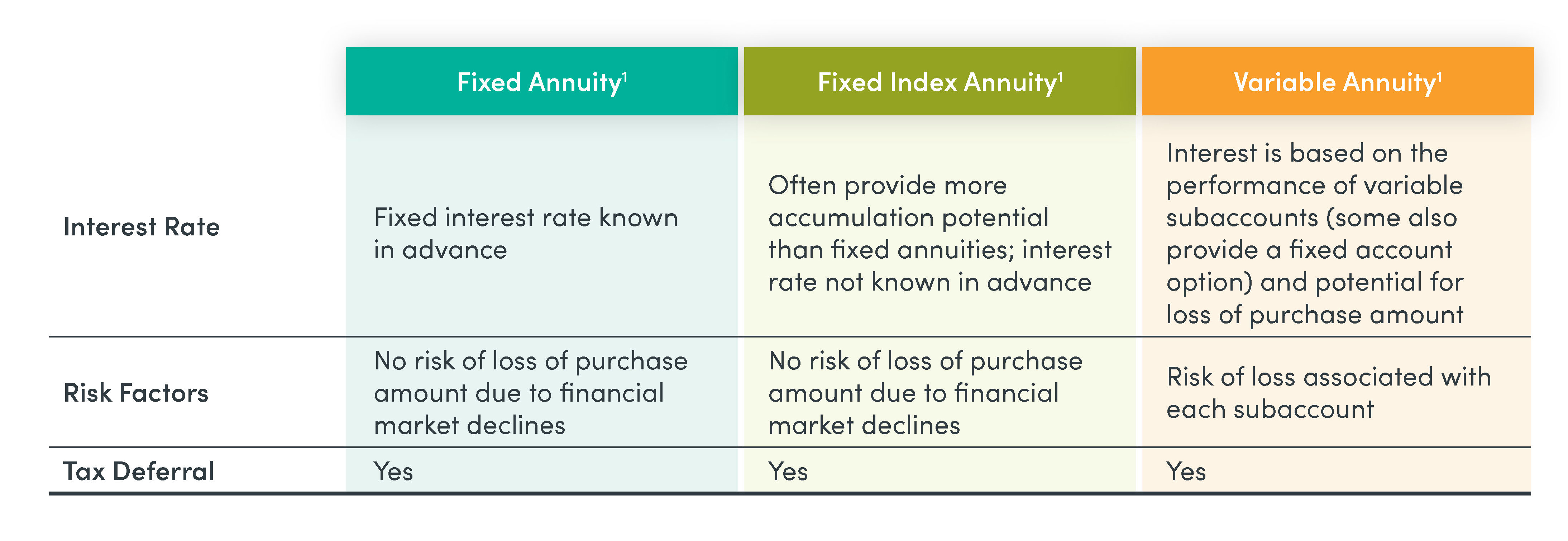

Difference Between Fixed And Variable Annuity

If I placed a recommendation in front of you, I'm additionally putting my license on the line. Keep in mind that (is annuity good for retirement). I'm very certain when I put something in front of you when we speak on the phone. That doesn't imply you have to take it. You might say, "Yes, Stan, you stated to purchase this A-rated business, yet I truly feel better with A dual and also." Penalty.

We have the Claims Paying Capability of the service provider, the state warranty fund, and my good friends, that are unknown, that are circling with the annuity mafia. That's an accurate answer of a person who's been doing it for a really, extremely long time, and that is that someone? Stan The Annuity Man.

People generally buy annuities to have a retired life revenue or to build cost savings for another purpose. You can buy an annuity from a qualified life insurance agent, insurance coverage company, monetary organizer, or broker - highest annuity returns. You ought to speak with a financial consultant about your demands and objectives prior to you get an annuity

The difference in between the 2 is when annuity repayments begin. You don't have to pay tax obligations on your earnings, or payments if your annuity is a specific retired life account (IRA), up until you take out the earnings.

Deferred and instant annuities use several options you can pick from. The choices give various levels of potential risk and return: are guaranteed to make a minimal rates of interest. They are the most affordable economic risk however give lower returns. earn a higher rates of interest, yet there isn't an assured minimum rates of interest.

Annuities Questions

Variable annuities are higher danger because there's a possibility you could lose some or all of your cash. Set annuities aren't as dangerous as variable annuities since the financial investment danger is with the insurance coverage business, not you.

If efficiency is low, the insurance provider births the loss. Set annuities ensure a minimum rates of interest, normally in between 1% and 3%. The company could pay a higher rate of interest than the ensured rate of interest - annuity estimates. The insurance policy company determines the rates of interest, which can alter regular monthly, quarterly, semiannually, or each year.

Index-linked annuities show gains or losses based upon returns in indexes. Index-linked annuities are more intricate than repaired delayed annuities. It is necessary that you recognize the attributes of the annuity you're taking into consideration and what they indicate. Both legal functions that affect the amount of interest attributed to an index-linked annuity the most are the indexing approach and the engagement rate.

Each relies upon the index term, which is when the company determines the rate of interest and credit scores it to your annuity (insurance annuities rates). The establishes just how much of the boost in the index will certainly be made use of to determine the index-linked passion. Various other important features of indexed annuities include: Some annuities cover the index-linked rate of interest

The flooring is the minimal index-linked rates of interest you will certainly gain. Not all annuities have a floor. All fixed annuities have a minimal surefire value. Some firms utilize the average of an index's worth rather than the value of the index on a specified date. The index averaging might happen whenever during the term of the annuity.

Various other annuities pay compound interest during a term. Substance interest is rate of interest earned on the cash you saved and the rate of interest you make.

Define Annuity Payment

If you take out all your money prior to the end of the term, some annuities won't credit the index-linked rate of interest. Some annuities may attribute just component of the passion.

This is since you birth the investment risk instead than the insurance provider. Your agent or economic adviser can assist you decide whether a variable annuity is best for you. The Stocks and Exchange Commission categorizes variable annuities as safeties since the efficiency is originated from stocks, bonds, and various other financial investments.

Income Annuity Definition

An annuity agreement has 2 stages: a build-up stage and a payment stage. You have several choices on just how you contribute to an annuity, depending on the annuity you buy: allow you to select the time and quantity of the settlement. annuity with highest interest rates.

The Internal Profits Service (IRS) controls the tax of annuities. If you withdraw your incomes prior to age 59, you will probably have to pay a 10% very early withdrawal penalty in addition to the taxes you owe on the rate of interest made.

Best Annuity Plan

After the build-up phase ends, an annuity enters its payment stage. This is in some cases called the annuitization stage. There are numerous choices for getting settlements from your annuity: Your firm pays you a dealt with quantity for the time specified in the contract. The company makes repayments to you for as long as you live, but there are not any settlements to your successors after you pass away.

Several annuities charge a penalty if you take out money prior to the payout phase - can you cancel an annuity. This fine, called a surrender fee, is normally highest in the very early years of the annuity. The fee is usually a percentage of the withdrawn cash, and usually begins at around 10% and drops every year up until the surrender duration is over

Table of Contents

Latest Posts

Understanding Fixed Income Annuity Vs Variable Annuity A Comprehensive Guide to Tax Benefits Of Fixed Vs Variable Annuities What Is Fixed Annuity Vs Variable Annuity? Advantages and Disadvantages of D

Analyzing Strategic Retirement Planning Everything You Need to Know About Pros And Cons Of Fixed Annuity And Variable Annuity What Is Fixed Vs Variable Annuities? Benefits of Choosing the Right Financ

Breaking Down Fixed Vs Variable Annuities A Closer Look at Choosing Between Fixed Annuity And Variable Annuity Breaking Down the Basics of Investment Plans Features of Immediate Fixed Annuity Vs Varia

More

Latest Posts